The price of long term care in the UK depends on where you live, the type of care you need, and who pays for it. Most people pay between £3,000 and £6,500 per month, with weekly fees often ranging from £700 to over £1,500.

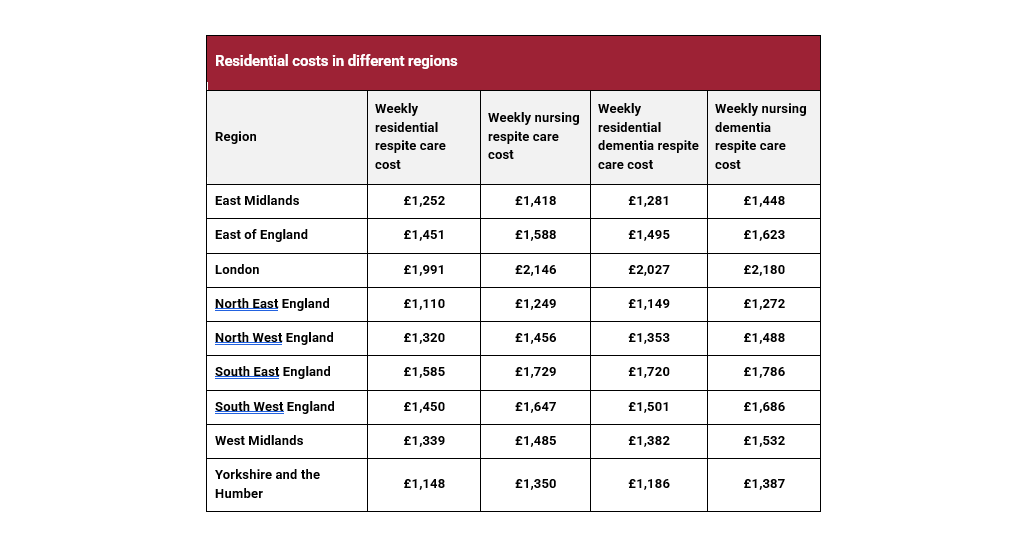

Residential care usually costs less than nursing or dementia care, and prices rise sharply in London and the South East. You may pay the full cost yourself, receive help from your local council, or qualify for NHS funding in specific circumstances.

Why the price of care homes in the UK varies so much

Care home costs in the UK vary because no two care situations look the same. The biggest factor is location. Care homes in London and the South East charge more because property, staffing, and operating costs run higher than in the North or rural areas.

The type of care also drives the price. Residential care covers daily support such as washing, dressing, and meals. Nursing care costs more because a registered nurse must be available around the clock. Dementia care often pushes fees higher again, as it requires closer supervision, specialist training, and higher staff-to-resident ratios.

Your level of need matters just as much. Someone who needs help a few times a day pays less than someone who needs constant support or clinical care. Care homes assess this before setting a fee.

Finally, provider quality and facilities affect the cost. Homes with higher inspection ratings, private rooms, specialist services, or lower staff turnover usually charge more. These differences explain why the price of care homes in the UK can vary widely, even within the same town.

How much does a care home cost in the UK?

When people ask how much does a care home cost, they usually want clear numbers. While prices vary, national averages give a useful starting point.

How much do care homes cost per week?

Across the UK, care home costs for people who fund their own care typically fall into these ranges:

- Residential care: around £700 to £1,300 per week

- Nursing care: around £850 to £1,550 per week

Homes in London and the South East often sit at the top end of these ranges, while prices tend to be lower in the North of England, Wales, and some rural areas.

How much does a care home cost per month UK?

To understand the price of long term care UK per month, it helps to convert weekly fees:

- £1,000 per week equals roughly £4,300 per month

- £1,300 per week equals roughly £5,600 per month

- £1,500 per week equals roughly £6,500 per month

This means the price of care homes in the UK for many self-funders sits between £3,000 and £6,500 per month, depending on care type and location.

Cost of old people’s home vs nursing home costs UK

A standard residential or “old people’s home” costs less because staff provide personal care rather than medical treatment. Nursing home costs UK are higher because a registered nurse must be available at all times, and care plans often involve medication management, wound care, or clinical monitoring.

Understanding these differences helps explain why the cost of care homes can rise quickly as care needs increase.

READ MORE: What does CQC stand for? Complete 2026 Guide

Dementia, nursing, and convalescent home costs

Specialist care almost always increases the price of long term care, because it demands more staff time, higher skill levels, and closer supervision.

Dementia care usually costs more than standard residential care. People living with dementia often need round-the-clock oversight, structured routines, and staff trained to manage confusion, distress, or challenging behaviour. For this reason, dementia units charge higher weekly fees, even when nursing care is not required.

Nursing care pushes costs higher again. Nursing homes must employ registered nurses at all times and provide clinical support alongside personal care. This requirement explains why nursing home costs UK sit above residential care fees, especially for people with complex medical needs.

Many people also ask about convalescent home costs. In the UK, this term often refers to short-term rehabilitation or recovery care following illness, surgery, or hospital discharge. These stays usually cost less than permanent nursing care but more than basic residential care, as they involve time-limited support and closer monitoring.

In all cases, the more intensive and specialist the care, the higher the ongoing care home costs will be.

SEE ALSO: Care Policies and Procedures: How to Implement Them Correctly in 2026

Who pays for care home costs in the UK?

Who pays the price of long term care depends on your health needs and your financial situation. In the UK, responsibility usually falls into one of three categories.

Paying for care yourself (self-funding)

You pay the full cost of care homes if your savings, investments, and assets sit above the upper capital limit set by your country within the UK. In England and Northern Ireland, this threshold is £23,250 for 2025–26. When your capital stays above this level, you cover the full care home bill, including accommodation and care.

Many people start as self-funders and later receive support if their savings fall below the threshold.

Help from the local authority

If your capital drops below the upper limit, your local council may help with care home costs UK after two assessments:

- A needs assessment to confirm that a care home is appropriate.

- A financial assessment (means test) to calculate how much you must contribute.

The council then sets a personal budget and pays part or all of the fee. If the care home charges more than the council rate, a relative or friend can choose to pay the difference. This extra payment is known as a top-up fee.

When the NHS pays

In limited situations, the NHS covers the full price of long term care UK. This happens through NHS Continuing Healthcare (CHC), which applies when someone has complex, ongoing health needs. CHC funding does not depend on savings or property, but it does not apply automatically.

If someone lives in a nursing home but does not qualify for CHC, they may still receive NHS-funded nursing care (FNC). In this case, the NHS pays a fixed weekly contribution toward nursing costs, while the individual or council covers the rest.

Understanding who pays helps families plan ahead and avoid unexpected care home fees.

New rules for care home payments

Many families ask about new rules for care home payments, especially after years of political debate around reform. The most important point is simple: there is currently no lifetime cap on care home fees in England.

The government previously planned to introduce an £86,000 cap on how much individuals would pay toward their personal care costs. This cap was later delayed and then scrapped, meaning people still face uncapped care home costs if they fund their own care.

What has not changed is the way councils assess contributions. Local authorities still rely on the Care Act framework, which uses a means test to decide how much someone must pay. Savings, income, and sometimes property continue to determine whether you pay the full cost or receive support.

What has changed in practice is pressure on prices. Rising staffing costs, increases to the National Living Wage, and higher employer National Insurance contributions have pushed providers to raise fees. These pressures affect the price of long term care UK private, especially for self-funders.

For people with significant health needs, the price of long term care UK NHS-funded remains protected through NHS Continuing Healthcare. However, eligibility remains strict and based on need, not diagnosis.

Understanding what rules apply today helps families plan realistically rather than relying on reforms that never took effect.

LEARN MORE: Starting a Care Home in the UK: Best 2026 Guide

Are next of kin responsible for care home fees?

Families often worry about whether relatives must pay care home bills. In most cases, next of kin are not responsible for care home fees.

Care home fees belong to the person receiving care, not their family. A care provider or local authority cannot legally force children, siblings, or other relatives to pay simply because of their relationship.

A relative only becomes financially involved in specific situations. This usually happens when they choose to contribute, such as agreeing to pay a third-party top-up fee. Top-ups allow someone to live in a more expensive care home than the council would normally fund, but they remain voluntary. Councils cannot require next of kin to sign top-up agreements.

In rare cases, confusion arises when relatives manage finances under a power of attorney. Even then, payments come from the person’s money, not the attorney’s personal funds.

Understanding this distinction helps families plan care with confidence and avoids unnecessary pressure or guilt around care home costs.

What care home fees include (and what they often charge extra for)

When comparing care home costs, it’s important to understand what the weekly or monthly fee actually covers. Most care homes bundle core services into a single price, but extras can quickly increase the total bill.

Care home fees usually include:

- Accommodation and use of shared facilities

- All meals and snacks

- Personal care, such as washing, dressing, and mobility support

- Laundry and basic housekeeping

- Heating, lighting, and other utility costs

However, many homes charge extra for non-essential services. These often include hairdressing, chiropody, toiletries, private outings, newspapers, and specialist therapies. Some homes also charge more for premium rooms, such as those with private bathrooms, larger spaces, or garden access.

These additional charges explain why the price of care homes in the UK can rise beyond the headline figure. Always ask for a written breakdown before signing a contract, so you can budget accurately and avoid unexpected increases in your care home fees.

ALSO SEE: How to Choose Home Care Agencies in the UK (2026)

Avoid surprise care home costs: questions to ask before you sign

Before agreeing to a placement, asking the right questions can save you from unexpected increases in the price of long term care. Care homes must be transparent, but families often overlook important details.

Ask the care home:

- What exactly does the weekly fee cover, and what costs extra?

- How often do you review and increase fees?

- Do you charge top-up fees, and who must pay them?

- Are there extra charges if care needs increase?

- What happens if funding switches from self-funded to council-funded?

- Do you charge administration or contract fees?

- Is notice required before fees change?

- Are specialist services, such as dementia support, included?

Getting clear answers helps you compare providers fairly and plan for future care home costs UK. Always request written confirmation, and take time to review the contract before committing.

Conclusion

The price of long term care in the UK can feel overwhelming, but clear information makes planning possible. Care home costs vary based on location, care type, and personal needs, with monthly fees often reaching several thousand pounds. Understanding how much care homes cost, what fees include, and who pays allows families to make informed decisions rather than rushed ones.

Whether you pay privately, receive help from your local authority, or qualify for NHS funding, early planning reduces stress and limits financial surprises. Always check contracts carefully, ask direct questions, and seek professional advice where needed. Taking these steps puts you in control of care choices and helps you prepare realistically for long-term care costs.

Need clarity on care home costs, funding rules, or long-term care decisions in 2026?

Many families and care providers only realise how complex long-term care funding is after costs rise, funding decisions change, or assumptions about council or NHS support turn out to be wrong. Unclear information around eligibility, assessments, and payment responsibilities often leads to financial pressure, delays, and difficult decisions made too late.

Care Sync Experts supports individuals, families, and care providers across England, Wales, and Northern Ireland to understand how long-term care costs actually work in practice, including self-funding, local authority support, NHS funding, and changing care needs.

Support typically includes:

- Clear explanations of care home costs, funding routes, and eligibility thresholds

- Guidance on local authority assessments, top-ups, and payment responsibilities

- Support understanding NHS Continuing Healthcare and funded nursing care pathways

- Practical insight to help families and providers plan confidently and avoid surprise costs

- Independent, regulation-aligned advice grounded in current UK health and social care requirements

Book a free initial consultation

If you’re unsure how care costs apply to your situation, whether funding support is available, or how future care needs could affect affordability, a short conversation now can help you plan with confidence and avoid costly mistakes later.

This article reflects UK health and social care funding frameworks and sector practice in 2026. Rules and thresholds may change, and outcomes depend on individual circumstances. Always refer to current guidance from the relevant authority.

FAQ

What is the average cost of long-term care in the UK?

The average cost of long-term care in the UK depends on the setting and level of support. Residential care typically costs £700 to £1,300 per week, while nursing care often ranges from £850 to £1,550 per week. This puts the average price of long term care UK per month between £3,000 and £6,500, with higher costs in London and the South East.

How much does 24-hour care at home cost in the UK?

24-hour care at home usually costs between £800 and £1,600 per week, depending on care needs and provider arrangements. This covers continuous support, including overnight care, but does not include household bills such as food, utilities, or rent. For couples, live-in care can work out cheaper than two separate care home placements.

What is the most expensive type of long-term care?

The most expensive type of long-term care is specialist nursing care, particularly when it involves complex medical needs or advanced dementia. This type of care requires registered nurses on duty at all times, higher staff ratios, and specialist equipment. As a result, fees often exceed standard nursing home costs UK averages and sit at the top end of care pricing.

Do the NHS pay for end-of-life care?

Yes, the NHS pays for end-of-life care when care needs are primarily health-related. This often happens through NHS Continuing Healthcare, which can fully fund care at home, in a hospice, or in a care home. Funding depends on clinical need, not income or savings, and applies regardless of a person’s financial situation.