A home reversion plan is a type of home equity release that allows homeowners aged 60 or over to sell part or all of their property to a provider in exchange for a lump sum or regular income.

In return, you receive a legally protected lifetime lease that lets you continue living in the property, usually rent-free or for a nominal rent. The provider recovers their share when the property is sold after your death or when you move into long-term care.

In simple terms, if you’ve ever asked, “Can I sell my house and still live in it rent-free?”, a home reversion plan makes that possible. However, you sell your share below full market value, and that decision permanently reduces the value of your estate.

Unlike a lifetime mortgage, a home reversion plan does not involve borrowing money or paying interest. Instead, you transfer ownership of a percentage of your home to the provider. The percentage you sell stays fixed, regardless of how property prices change in the future.

Home reversion plans fall under UK financial regulation. The Financial Conduct Authority (FCA) regulates providers, and many follow standards set by the Equity Release Council, including guarantees such as the right to remain in your home for life.

Home Reversion Plan: Key Facts at a Glance

- Minimum age: Most providers require all applicants to be at least 60 or 65 years old.

- Ownership transfer: You sell between 20% and 60% of your property to the provider.

- Below market value: Providers pay less than the full market value for the share you sell.

- No monthly repayments: You do not make interest payments because this is not a loan.

- Lifetime security: You receive a lifetime lease that allows you to stay in your home.

- Inheritance impact: Selling part of your property significantly reduces what you can leave to beneficiaries.

- Fixed percentage: The provider’s ownership share stays fixed, even if house prices rise or fall.

- Regulation: The Financial Conduct Authority regulates home reversion equity release products, and many providers follow the standards set by the Equity Release Council.

- Benefits impact: Releasing cash may affect eligibility for means-tested benefits.

- Not a home purchase plan: A home reversion plan differs from Islamic home purchase plans or traditional home income plans, despite the similar terminology.

In short, a home reversion plan gives you access to cash without monthly repayments, but it permanently transfers ownership of part of your home.

RELATED: Who Is a Care Assistant? 2026 Salaries, Duties, Responsibilities

How does a home reversion plan work step by step?

Many people ask, “How does equity release work?” A home reversion plan follows a clear process. Here’s how it typically works:

1. Property valuation

The provider arranges an independent valuation of your home to determine its current market value. This valuation forms the basis of the offer.

2. You agree to sell a percentage

You choose how much of your home to sell, usually between 20% and 60%. The provider offers a lump sum, regular income, or a combination of both. Because the provider allows you to stay in the property for life, they pay less than full market value for the share.

3. You receive a lifetime lease

You sign a legally protected lifetime lease. This agreement allows you to live in the property for the rest of your life or until you move into permanent long-term care. In most cases, you pay no rent or only a nominal amount.

4. You receive your money

After completing legal checks and advice requirements, the provider releases the agreed funds. You can use the money for any purpose, including supplementing retirement income, supporting family members, or funding care needs.

5. The property is eventually sold

When you die or move permanently into long-term care, the property is sold. The provider receives their fixed ownership percentage. Your estate receives the remaining percentage.

This structure explains how to release equity from your home without taking on debt. Unlike a lifetime mortgage or lifelong mortgage, you do not borrow money, and you do not accumulate interest. Instead, you give up ownership of a share of your property.

How does equity release work when you die?

With a home reversion plan, your estate does not repay a loan. Instead, the property is sold, and the sale proceeds are split according to the agreed ownership percentages. If you sold 40%, the provider receives 40% of the final sale price. Your estate receives 60%.

This difference makes home reversion equity release structurally simpler than interest-based options, but it also means you permanently reduce your estate from day one.

READ MORE: Is MS Hereditary or Inherited? What Causes Multiple Sclerosis (2026)

Home Reversion Plan Example (With Numbers)

Many homeowners ask, “How much equity can I release from my home?” The answer depends on your age, health, and property value. Let’s look at a clear home reversion plan example.

Scenario

- Property value: £300,000

- Age: 75

- Share sold: 40%

- Market value of 40%: £120,000

- Actual payout offered: £90,000

The provider pays less than full market value because they may wait many years before selling the property.

You continue living in the home under a lifetime lease.

What happens if house prices rise?

Ten years later, the property sells for £360,000.

- Provider receives 40% = £144,000

- Your estate receives 60% = £216,000

Even though you received £90,000 originally, the provider benefits from future price growth on their 40% share.

What happens if house prices fall?

If the property sells for £250,000:

- Provider receives 40% = £100,000

- Estate receives 60% = £150,000

The ownership split stays fixed. The provider does not charge interest. Your estate simply receives whatever remains after their percentage.

How much equity release can I get?

Most providers allow you to sell between 20% and 60% of your home. The older you are, the higher the percentage you may qualify for. Health conditions can also increase the amount offered.

Online tools, such as a home reversion plan calculator or even an Aviva equity release calculator, can give rough estimates. However, calculators cannot replace formal advice because offers vary by provider and personal circumstances.

This example shows why home reversion equity release permanently changes your estate value. You exchange a fixed share of future property growth for guaranteed cash today.

What does a home reversion plan really cost?

A home reversion plan does not charge interest, but it still carries real costs. Many homeowners focus only on the lump sum and overlook the long-term trade-offs.

1. You sell below market value

This is the largest hidden cost.

Providers pay less than the true market value for the share you sell. In our earlier example, 40% of a £300,000 property equals £120,000. The provider paid £90,000 instead. That £30,000 difference reflects the cost of allowing you to stay in the property for life.

The younger you are, the larger that discount usually becomes.

2. Professional fees

You must budget for:

- Arrangement fees

- Independent valuation fees

- Legal fees (you must appoint your own solicitor)

- Financial adviser fees

The Equity Release Council requires independent legal advice before completion.

3. Ongoing responsibilities

Even after you sell part of your home, you remain responsible for:

- Property maintenance

- Buildings insurance

- Repairs

If you fail to maintain the property, you may breach the lifetime lease agreement.

4. Impact on benefits

If you receive means-tested benefits, releasing cash could reduce or remove your entitlement. Always check before proceeding.

5. Reduced inheritance

This cost often matters most to families. Once you sell a share of your home, you permanently reduce the value of your estate. You cannot easily reverse the decision.

This is why financial commentators, including those often cited in searches like “equity release Martin Lewis,” consistently stress the importance of independent advice before committing.

Is there a “best home reversion plan”?

There is no universal best home reversion plan. The right option depends on:

- Your age

- Your health

- Your property value

- Your inheritance goals

- Whether alternatives such as a lifetime mortgage suit you better

Some of the best equity release companies operate under Equity Release Council standards, but suitability always depends on personal circumstances.

SEE MORE: New Rules for Care Home Payments in 2026

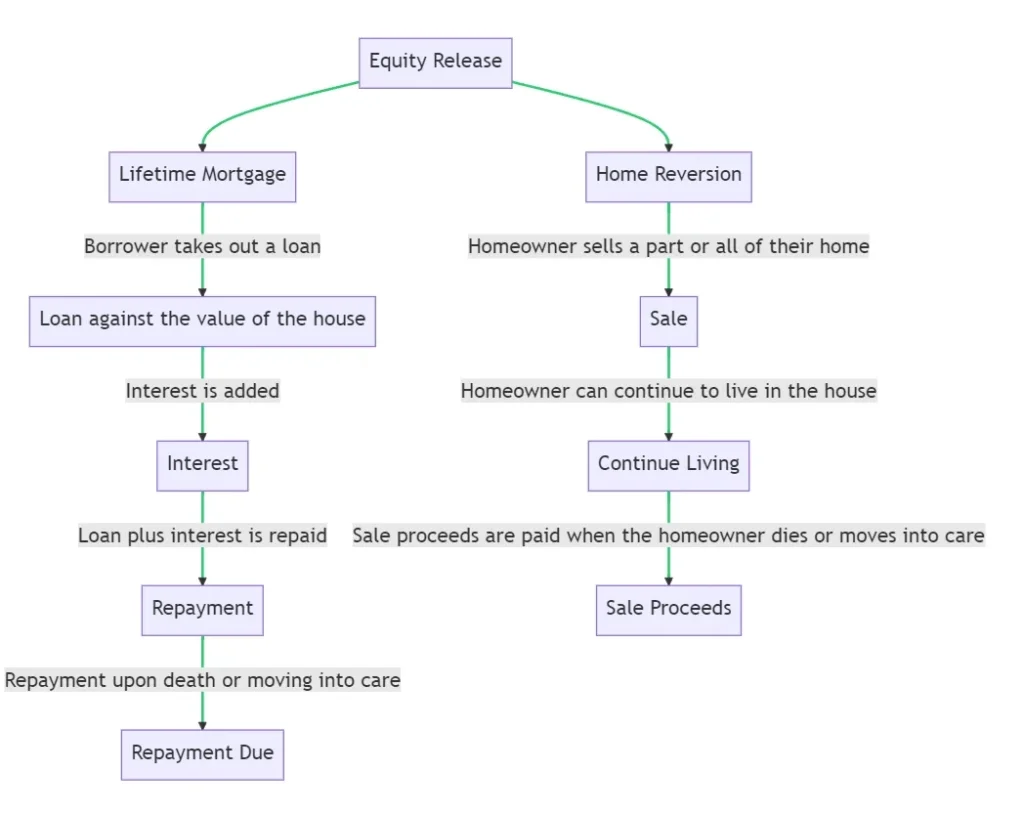

Home Reversion Plan vs Lifetime Mortgage

Many homeowners searching for a home reversion plan eventually compare it with a lifetime mortgage. Both fall under home equity release, but they work very differently.

What is a lifetime mortgage?

A lifetime mortgage is a loan secured against your home. You keep full ownership, but the lender charges interest on the amount you borrow. The loan and accumulated interest are usually repaid when you die or move into long-term care.

Some people refer to it as a lifelong mortgage, but the correct term is lifetime mortgage.

Key Differences at a Glance

| Home Reversion Plan | Lifetime Mortgage |

| You sell part of your home | You borrow against your home |

| No interest charges | Interest compounds over time |

| Ownership percentage fixed | Debt increases over time |

| Usually available from age 60+ | Usually available from age 55+ |

| Provider benefits from house price growth | You keep full ownership growth |

| No loan repayment required | Loan plus interest repaid from sale |

Which option gives you more money?

A lifetime mortgage often provides a higher initial payout because you retain ownership. However, interest compounds over time and can significantly reduce the estate.

A home reversion plan usually pays less upfront but does not accumulate debt.

When might a lifetime mortgage make more sense?

A lifetime mortgage may suit you if:

- You want to keep full ownership

- You expect strong property growth

- You plan to repay early

- You want more flexibility

When might a home reversion plan make more sense?

A home reversion plan may suit you if:

- You are older

- You want no interest risk

- You prefer fixed ownership percentages

- You prioritise certainty over potential growth

When comparing home reversion plan vs equity release, remember that a home reversion plan is a form of equity release. The real comparison is between selling ownership and borrowing against it.

Before choosing either option, ask yourself: Do I want to sell part of my home, or do I want to take on debt secured against it?

That distinction drives the decision.

Can I sell my house and still live in it rent-free?

Yes, a home reversion plan allows you to sell part (or all) of your property and continue living in it for life.

When you take out a home reversion plan, the provider grants you a lifetime lease. This lease gives you the legal right to remain in your home until you die or move permanently into long-term care.

In most cases, you do not pay rent. Some plans may include a nominal rent or fixed rental agreement, but providers must disclose this clearly before you sign.

However, rent-free does not mean responsibility-free.

You still must:

- Maintain the property

- Keep buildings insurance in place

- Comply with the lease conditions

If you fail to maintain the home, you may breach the agreement.

This structure explains how to get equity out of your home without monthly repayments. But remember: once you sell a share, you cannot usually buy it back. The ownership transfer remains permanent.

If your main goal is lifetime security without debt, a home reversion plan delivers that. If your priority is retaining full ownership, you may prefer a lifetime mortgage instead.

READ: CQC Supported Living Registration in 2026: The Complete Guide

Who is a home reversion plan suitable for?

A home reversion plan does not suit everyone. It works best in specific situations.

It may suit you if:

You are over 70 and want certainty.

Older applicants often receive better offers because providers expect a shorter plan duration. If you value guaranteed occupancy and predictable outcomes, this structure may appeal to you.

You need funds to cover care costs.

Many families use home equity release to help pay for in-home care or residential care. If you want to remain in your property while freeing up cash for support, a home reversion plan can provide immediate liquidity.

Inheritance is not your main priority.

If you do not depend on passing on the full value of your property, selling a fixed share may feel acceptable.

You want no interest risk.

Unlike a lifetime mortgage, a home reversion plan does not build debt over time. Some homeowners prefer a fixed ownership split rather than watching interest compound.

You want long-term housing security.

The lifetime lease protects your right to remain in your home. That certainty matters to many older homeowners.

From a caregiver perspective, this option can help families create financial breathing room. It can fund professional care without forcing a property sale. However, it permanently reshapes estate planning.

If protecting inheritance matters deeply to you or your family, you must weigh that carefully before proceeding.

When a Home Reversion Plan May Not Be Right for You

A home reversion plan creates permanent consequences. You should pause carefully if any of the following apply to you.

You want to protect as much inheritance as possible

Once you sell part of your home, you permanently reduce your estate. If leaving property wealth to children or beneficiaries remains a priority, other options may suit you better.

You expect strong property price growth

When house prices rise, the provider benefits from the share you sold. If you believe your property will significantly increase in value, selling a fixed percentage may limit your long-term wealth.

You are relatively young (early 60s)

Providers apply larger discounts to younger applicants. You may receive far less than the true market value of your share. In some cases, a lifetime mortgage may provide more flexibility at that stage.

You rely on means-tested benefits

Releasing cash can affect entitlement to Pension Credit, Council Tax Reduction, or other benefits. Always check before proceeding.

You may want to reverse the decision later

Home reversion plans are difficult and expensive to unwind. If you value flexibility, this structure may feel restrictive.

If any of these concerns resonate, explore alternatives such as downsizing or comparing a lifetime mortgage more closely. Always seek regulated advice before committing.

SEE: Zero Hour Agreement in UK Care: How to Stay Compliant (2026)

How Home Reversion Plans Are Regulated in the UK

A home reversion plan falls under strict UK financial regulation.

The Financial Conduct Authority (FCA) regulates providers that offer home reversion equity release products. This regulation requires firms to assess suitability, explain risks clearly, and treat customers fairly.

Most reputable providers also follow standards set by the Equity Release Council. These standards include:

- The right to remain in your home for life

- Clear disclosure of costs and implications

- Mandatory independent legal advice

- Protection against forced eviction

Before completing a home reversion plan, you must take independent financial advice. Providers cannot proceed without confirming that you have received regulated advice and legal guidance.

If you compare products, you may encounter tools like an Aviva equity release calculator or other provider calculators. These tools provide estimates only. They do not replace regulated advice.

When researching the best equity release companies, check whether the provider:

- Is authorised by the FCA

- Is a member of the Equity Release Council

- Provides clear, transparent documentation

Regulation does not remove risk, but it ensures that providers follow strict consumer protection rules.

How Much Equity Can I Release From My Home?

Many homeowners ask:

- How much equity can I release from my home?

- How much equity release can I get?

- Can I release equity from my house without selling all of it?

With a home reversion plan, the amount depends on four main factors:

1. Your age

The older you are, the larger the percentage you may qualify to sell. Providers calculate this based on life expectancy.

2. Your health

Some providers offer enhanced terms if you have serious medical conditions.

3. Your property value

Higher-value properties typically unlock higher payouts.

4. The percentage you choose to sell

Most plans allow you to sell between 20% and 60%.

Example

If your property is worth £400,000 and you qualify to sell 50%, the market value of that share equals £200,000. However, the actual lump sum offered may fall significantly below that figure because the provider must wait to recover its share.

Online tools, such as a home reversion plan calculator or broader equity release calculators, can provide rough estimates. Some homeowners search for tools like an Aviva equity release calculator for guidance. These tools help with ballpark figures but cannot replace formal advice.

Unlike a lifetime mortgage, you do not calculate borrowing capacity or interest projections. Instead, you negotiate ownership percentage and upfront payout.

If you want to understand how to take equity out of your home safely, start by clarifying your financial goal:

- Do you need income now?

- Do you want to fund care?

- Do you want certainty without interest?

Your answer determines whether a home reversion plan fits your situation.

MORE: Care Policies and Procedures: How to Implement Them Correctly in 2026

Before You Sign a Home Reversion Plan: Key Questions to Ask

A home reversion plan creates a permanent financial decision. Before you move forward, pause and ask yourself the right questions.

1. Do I fully understand what I am selling?

You are not borrowing money. You are transferring ownership of a percentage of your home. Once you sell that share, you cannot easily reverse the decision.

2. Have I compared this with a lifetime mortgage?

A lifetime mortgage keeps ownership in your name but builds interest over time. A home reversion plan fixes ownership from the start. Make sure you understand both structures clearly before choosing.

3. How important is inheritance to me?

Selling part of your home permanently reduces the estate you leave behind. Discuss this openly with family members if inheritance matters to you.

4. Could this affect my benefits?

If you receive means-tested benefits, releasing equity may reduce or remove your entitlement. Confirm the impact before proceeding.

5. Have I taken independent financial and legal advice?

UK regulation requires it for good reason. A qualified adviser can explain:

- How equity release works in your specific case

- The long-term implications

- Whether downsizing or alternative planning might serve you better

Final Thoughts…

A home reversion plan offers certainty. You avoid monthly repayments, eliminate interest risk, and secure your right to stay in your home for life.

But certainty comes at a cost. You sell part of your property below market value, and you permanently reduce your estate.

If your priority is guaranteed housing security and immediate cash without debt, this option may work well. If you want flexibility or maximum inheritance protection, you may need to explore alternatives.

Take your time. Compare options carefully. Seek regulated advice. And make sure the decision aligns with your long-term goals, not just your immediate financial needs.

Considering a Home Reversion Plan or Equity Release in the UK?

If you searched “home reversion plan,” “how much equity can I release from my home,” “home reversion plan vs lifetime mortgage,” “can I sell my house and still live in it rent-free,” or “how does equity release work when you die,” you are likely making a serious financial decision, either for yourself, a parent, or someone you support.

Clear, accurate information matters. Poor advice, rushed decisions, and misunderstanding ownership transfers can permanently reduce inheritance, affect benefits, and limit future financial flexibility.

Care Sync Experts supports families, caregivers, and regulated care providers across the UK with:

- Clear interpretation of FCA and Equity Release Council standards

- Structured financial decision frameworks for later-life planning

- Governance guidance for care providers advising clients on funding options

- Support navigating care funding vs property-based release decisions

- Risk modelling for inheritance and estate planning implications

- Policy and documentation systems for care businesses discussing equity release responsibly

- Tender-writing and compliance support for services involved in financial care planning

- Inspection readiness support where funding advice intersects with regulated care delivery

Whether you are exploring how to release equity from your home, funding long-term care, or supporting vulnerable adults through complex financial decisions, we help you move from uncertainty to structured, compliant decision-making.

Speak with Care Sync Experts today and ensure your financial planning conversations remain informed, regulated, and built to withstand scrutiny, from families, advisers, and regulators alike.

FAQ

What is the minimum age for home reversion?

Most providers require applicants to be at least 60 years old, although some set the minimum age at 65. If you apply jointly, both homeowners must meet the age requirement.

The older you are, the higher the percentage of your property you may be allowed to sell. Providers calculate this based on life expectancy and risk assumptions.

Always confirm the minimum age with a regulated adviser, as criteria vary slightly between providers.

What is the cheapest way to get equity out of a house?

There is no universal “cheapest” way to release equity. The right option depends on your goals, age, income, and long-term plans.

Common options include:

– Remortgaging (often cheaper if you have income and qualify)

– Home equity loan

– Lifetime mortgage

– Home reversion plan

– Downsizing

If you qualify for standard mortgage lending, remortgaging often carries lower overall costs than equity release products. However, many older homeowners no longer meet traditional lending criteria.

In those cases, lifetime mortgages or home reversion plans may become viable alternatives.

Cost should never be assessed purely by upfront fees. You must also consider long-term interest, ownership loss, inheritance impact, and flexibility.

What are the disadvantages of a lifetime mortgage?

A lifetime mortgage allows you to borrow against your home while retaining ownership, but it carries several risks:

– Compound interest increases the total debt over time.

– The loan plus interest reduces the value of your estate.

– Early repayment charges can apply.

– It may affect eligibility for means-tested benefits.

– Property maintenance remains your responsibility.

While lifetime mortgages offer flexibility and higher initial payouts compared to some home reversion plans, the accumulating interest can significantly reduce inheritance if the loan runs for many years.

Can I borrow money against my house?

Yes. You can borrow money against your home in several ways:

– Remortgaging

– Taking a secured home equity loan

– Using a lifetime mortgage (if aged 55+)

– Using other forms of equity release

Traditional borrowing requires proof of income and affordability checks. Equity release products do not require monthly repayments in the same way, but carry long-term implications.

Before borrowing against your house, consider:

– Your age

– Your income stability

– Your inheritance plans

– Your long-term housing intentions

Always seek regulated financial advice before using your property as security.