TL;DR: What the Employment Rights Bill Means for Workers

The Employment Rights Bill (often searched as the employee rights bill or Employment Rights Bill 2024) introduces phased employment law changes 2025–2027 that directly affect care providers across England, Wales, Scotland, and Northern Ireland. If you employ a care assistant, support worker, or healthcare assistant, you must prepare now.

Here is what you should know:

- From 2026–2027: Workers gain stronger rights around predictable hours, sick pay, family leave, and protection from unfair dismissal.

- From October 2026: Employers must take “all reasonable steps” to prevent harassment, including harassment by service users and family members.

- Tribunal risk increases: Employees will have longer to bring claims, and tribunals can uplift compensation if you fail to meet prevention duties.

- Costs will rise: Scheduling reforms, sick pay changes, and sector-wide pay negotiations will affect margins, especially in domiciliary care and 24 hour home care models.

- Action required now: Audit contracts, update policies, model staffing costs, strengthen record-keeping, and train managers before deadlines hit.

This guide breaks down what the Employment Rights Bill changes, how it affects care assistant duties, rota management, and dismissal risk, and what care providers must implement before 2026–2027.

Key Dates:

The Employment Rights Bill moves in phases. Care providers must track each stage carefully and avoid assuming everything changes at once.

Here are the dates that matter:

- 26 October 2024 – Employers must take reasonable steps to prevent sexual harassment. This duty already applies.

- 18 December 2025 – The Employment Rights Act 2025 received Royal Assent, formally introducing wide-ranging employment law changes 2025.

- April 2026 (expected implementation phase) – Whistleblowing protections expand, and early elements of reform begin to take effect.

- October 2026 – Employers must take “all reasonable steps” to prevent harassment, including third-party harassment. Tribunal time limits extend from three to six months.

- 2026–2027 (phased roll-out) – Predictable-hours rights, zero-hours reform, and strengthened unfair dismissal protections come into force.

- 2027 – Workers on low-hours or variable contracts gain rights to guaranteed hours reflecting actual work patterns, along with compensation for cancelled shifts.

These new rules in UK employment law do not arrive overnight, but they build quickly. If you operate domiciliary care, supported living, or 24 hour live in care services, you should treat 2026 as your practical compliance deadline.

RELATED: National Minimum Wage 2026 for Care Providers: Compliance Risks and FWA Enforcement

Why the Care Sector Feels These Changes First

The Employment Rights Bill affects every employer, but care providers will feel the pressure faster and harder than most sectors.

You operate on narrow margins. You manage complex rotas. You employ large numbers of care assistants, support workers, healthcare assistants, and mental health support workers across multiple settings. When employment law changes 2025 tighten worker protections, your operational model absorbs the shock immediately.

Unlike office-based industries, care services rely on:

- Variable-hours contracts for domiciliary care

- Night shifts and lone working

- 24 hour home care and 24 hour live in care packages

- Agency and bank staff

- High turnover in assistant caregiver roles

If predictable-hours rights expand in 2027, rota flexibility reduces. If sick pay becomes payable from day one, absence costs increase. If unfair dismissal protection shortens qualifying periods, probation management becomes riskier. If tribunal time limits double, your exposure window expands.

Care settings also face higher third-party interaction risk. A care assistant delivering personal care in someone’s home cannot control every environment. A support worker in supported living interacts with visitors, family members, and external professionals daily. These realities make harassment prevention and dismissal decisions more complex under the employee rights bill reforms.

In short, employment law rarely hits care providers in theory. It hits you in scheduling, payroll, recruitment, safeguarding, and contracts, all at once.

What the Employment Rights Bill Actually Changes

Many providers hear “Employment Rights Bill” and assume it is just another update to employment law. It is not. This legislation restructures core employer obligations across pay, scheduling, dismissal, and harassment.

The Employment Rights Bill 2024, now enacted as the Employment Rights Act 2025, introduces phased reforms between 2026 and 2027. These reforms aim to strengthen worker protections, increase job security, and shift more responsibility onto employers.

Here is what that means in practical terms:

- Workers on irregular or low-hours contracts gain stronger rights to predictable income.

- Employers must tighten dismissal processes as qualifying periods shorten.

- Sick pay and family leave protections expand.

- Harassment prevention duties move from “reasonable steps” to “all reasonable steps.”

- Tribunal time limits extend, increasing litigation exposure.

These are not cosmetic updates. They reshape how you structure contracts, manage rotas, document decisions, and train managers.

If you run a service employing care assistants, support workers, or healthcare assistants, you must now treat workforce compliance as a strategic function, not just an HR task.

The remainder of this guide breaks down each reform in detail and shows how it affects domiciliary care, care homes, supported living services, and assistant caregiver job structures.

READ MORE: Zero Hour Agreement in UK Care: How to Stay Compliant (2026)

Staffing & Scheduling: Zero-Hours Reform and Predictable Hours

The Employment Rights Bill targets variable and zero-hours working patterns, a model many care providers rely on to deliver flexible support.

From 2026–2027 (phased implementation), workers on low or unpredictable hours will gain stronger rights to:

- Guaranteed hours that reflect their actual working pattern

- Advance notice of shifts

- Compensation for cancelled or curtailed shifts

If you run domiciliary care or 24 hour home care services, this affects how you build rotas for every care assistant, support worker, and mental health support worker on your books.

Care providers often:

- Increase hours during winter pressures

- Cancel visits when packages change

- Use bank staff to fill last-minute gap

- Adjust shifts when service users enter hospital

Under the employment law changes 2025, these routine adjustments may trigger financial consequences.

If a care assistant regularly works 35 hours despite holding a 10-hour contract, you may need to offer a contract that reflects reality. If you cancel shifts at short notice due to package withdrawal, you may need to compensate the worker.

This reform directly impacts:

- Domiciliary care agencies

- Supported living providers

- 24 hour live in care models

- Services relying heavily on assistant caregiver job flexibility

What You Should Do Now

Do not wait for 2027 implementation. Start building evidence and systems now:

- Audit actual hours worked versus contracted hours

- Track cancelled or shortened shifts

- Review probationary contract templates

- Model cost exposure under guaranteed-hours scenarios

- Speak to commissioners about pricing assumptions

If you fail to align contracts with real working patterns, you increase exposure to tribunal claims and compliance challenges under the employee rights bill reforms.

The providers who adapt early will protect margins. The providers who ignore rota data will struggle to defend their decisions later.

Pay, Terms and the Adult Social Care Negotiating Body

The Employment Rights Bill does not only change contracts and scheduling. It also reshapes how pay develops across the care sector.

The government plans to introduce an Adult Social Care Negotiating Body to agree sector-wide pay rates and employment standards. This move aims to improve retention, reduce turnover, and stabilise the workforce. In theory, it strengthens career pathways for every care assistant, support worker, and healthcare assistant.

In practice, it increases cost pressure on providers.

What This Means for Care Providers

If national minimum pay bands rise through negotiated agreements, you will need to:

- Review your care assistant job specification and pay structure

- Recalculate margins on council contracts

- Adjust recruitment budgets for support worker jobs

- Update assistant caregiver job descriptions to reflect new standards

Higher baseline pay may improve recruitment in care assistant jobs and mental health support worker roles. However, unless commissioners increase contract rates, your wage bill rises without matching income.

This creates a direct tension between:

- Workforce stability

- Contract viability

- Service sustainability

What You Should Do Now

Do not wait for formal pay bands to appear before preparing.

Start by:

- Modelling wage increases of 5–15% across frontline role

- Reviewing contracts with local authorities for uplift clauses

- Identifying services operating on the tightest margins

- Building a clear evidence pack showing cost increases

Commissioners increasingly expect providers to justify pricing with workforce data. If you prepare now, you position yourself as credible and proactive when negotiating rates.

The Employment Rights Bill strengthens worker protections. Care providers must strengthen financial planning at the same time.

SEE ALSO: Price of Long Term Care in the UK: Care Home Costs (2026 Guide)

Sick Pay, Leave, and Day-One Rights: What Changes for Care Employers

The Employment Rights Bill strengthens statutory protections around sick pay and family leave. For care providers, these reforms affect daily operations more than policy wording.

From 2026 onwards (phased implementation), reforms are expected to:

- Remove waiting periods for Statutory Sick Pay (SSP), making sick pay payable from the first eligible day

- Expand eligibility for lower-income workers

- Strengthen “day-one” rights for certain family-related leave

- Shorten qualifying periods for protection against unfair dismissal

For employers of care assistants, support workers, and healthcare assistants, this means absence management must tighten.

Care services face:

- High exposure to illness (especially in 24 hour home care and residential care)

- Frequent short-term absence

- Infection control obligations

- Reliance on bank or agency cover

If sick pay becomes payable earlier and unfair dismissal protections attach sooner, you cannot treat early absence during probation as a low-risk decision.

Managers must understand the difference between:

- Unfair dismissal (statutory rights and fairness test)

- Wrongful dismissal (breach of contract, such as failing to give notice)

Under strengthened employment law protections, probation management errors may lead to claims faster than before.

What You Should Do Now

Prepare your service before changes take full effect:

- Update absence and sick pay policies

- Train managers on lawful probation reviews

- Document performance concerns clearly and early

- Review your assistant caregiver job description and expectations for attendance

- Ensure payroll systems can adapt quickly

If you employ frontline roles such as care assistant or mental health support worker, you must assume that dismissal decisions made within the first year of employment will face closer scrutiny under the employment law changes 2025.

Strong documentation protects you. Informal conversations do not.

The Employment Rights Bill strengthens worker security. Your processes must match that strength.

MORE: CQC Registration for Domiciliary Care Providers: Complete 2026 Guide

Dismissals, Tribunal Risk and Wrongful Dismissal Exposure

The Employment Rights Bill increases legal risk when you dismiss staff. Care providers must now treat every dismissal as potentially reviewable by a tribunal within a longer window.

From October 2026, the time limit for most employment tribunal claims increases from three months to six months. This change alone doubles your exposure period.

At the same time, qualifying periods for certain protections shorten, meaning employees may access unfair dismissal rights earlier in their employment.

Unfair vs Wrongful Dismissal: Know the Difference

Care managers often confuse two separate legal concepts:

- Unfair dismissal: You failed to follow a fair process or lacked a fair reason under employment law.

- Wrongful dismissal: You breached the employee’s contract, often by failing to give proper notice or pay.

Both risks increase under the employment law changes 2025.

If you dismiss a care assistant during probation without evidence of performance concerns, you risk an unfair dismissal claim sooner than before.

If you dismiss a support worker immediately without contractual notice, you risk wrongful dismissal even if your reason was valid.

Why Care Providers Face Higher Risk

Care environments create complex dismissal situations:

- Safeguarding allegations requiring immediate suspension

- Performance concerns linked to care assistant duties

- Conduct issues involving service users

- Lone-working safety breaches

Under the employee rights bill reforms, you must show:

- A clear reason for dismissal

- A documented investigation

- Evidence you considered alternatives

- A fair hearing process

If you cannot produce records six months later, your defence weakens significantly.

What You Should Do Now

Before terminating any employee, ensure you:

- Confirm the contractual notice requirement

- Follow a documented disciplinary or capability process

- Keep detailed investigation notes

- Separate safeguarding action from employment decision-making

- Provide written outcome letters

Train managers to avoid informal dismissals. Phrases like “it’s just not working out” no longer provide safe ground.

The Employment Rights Bill does not remove your ability to dismiss staff. It removes your ability to do it casually.

Care providers who strengthen process now will avoid costly tribunal claims later.

Harassment, Third-Party Risk and the “All Reasonable Steps” Duty

The Employment Rights Bill significantly strengthens employer responsibility for preventing workplace harassment. Care providers face particular exposure because your staff work in environments you do not fully control.

From October 2026, employers must take “all reasonable steps” to prevent harassment. This replaces the current “reasonable steps” standard and raises the bar.

At the same time, employers will become directly liable for harassment of staff by third parties, including:

- Service user

- Family members

- Visitors

- Contractors

- External professionals

For care providers, this risk is real and immediate.

Why This Reform Hits Care Harder

A care assistant delivering 24 hour live in care works alone in a private home.

A support worker in supported living interacts daily with residents’ visitors.

A mental health support worker may manage behaviours linked to trauma or cognitive conditions.

These environments increase the likelihood of inappropriate conduct. Under the strengthened duty, you must prove you did everything reasonably possible to prevent it.

Tribunals will examine:

- Your policy

- Your training

- Your reporting routes

- Your risk assessments

- Your actions after incidents

If any of these elements are missing, you weaken your defence.

What “All Reasonable Steps” Looks Like in Care

In practical terms, you should already be able to demonstrate:

- A clear anti-harassment policy that includes third-party behaviour

- Care-plan risk flags where previous incidents occurred

- Two-carer arrangements for high-risk visits

- A safe withdrawal protocol for staff

- Multiple reporting routes that do not rely solely on line managers

- Manager training on trauma-informed responses

If a service user behaves inappropriately toward a healthcare assistant, your records must show:

- The incident was documented

- The care plan was reviewed

- Risk controls were updated

- You communicated boundaries where appropriate

- You protected the employee from further exposure

With tribunal time limits extending to six months, you must preserve:

- Training attendance logs

- Risk assessment updates

- Incident reports

- Investigation outcomes

- Manager decisions and rationale

If you cannot evidence these steps, you may struggle to rely on the “all reasonable steps” defence.

The Employment Rights Bill does not expect perfection. It expects preparation.

Care providers who treat harassment prevention as a live operational risk, not just a policy requirement, will position themselves far more safely under the employment law changes 2025.

LEARN MORE: CQC Application 2026: Avoid Rejection From 9 February (Supporting Documents, Registered Manager Guide)

Payroll & Compliance Watch: HMRC Rule Changes (22 October 2025)

While the Employment Rights Bill focuses on worker protections, care providers must also monitor parallel compliance deadlines that affect payroll and reporting.

One important date to note is 22 October 2025. If your organisation operates a PAYE Settlement Agreement (PSA), HMRC requires electronic payment clearance by this date to avoid interest or penalties.

This is not a reform introduced by the employee rights bill itself. However, it sits within the same broader landscape of tightening compliance expectations for employers.

Care organisations often manage:

- Large frontline workforces

- Overtime and variable-hour payments

- Mileage reimbursements for domiciliary care

- Uniform allowances

- Staff benefit schemes

If payroll processes slip, especially during periods of legislative change, HMRC penalties can add financial strain to an already pressured operating model.

What You Should Do Now

- Confirm whether your organisation operates a PSA

- Review payroll reporting processes

- Ensure finance and HR teams align on compliance deadlines

- Document internal responsibility for statutory submission

Employment law changes 2025 will already require policy updates and training investment. Avoid compounding risk with preventable payroll non-compliance.

Care providers must treat workforce reform and financial compliance as part of the same governance framework.

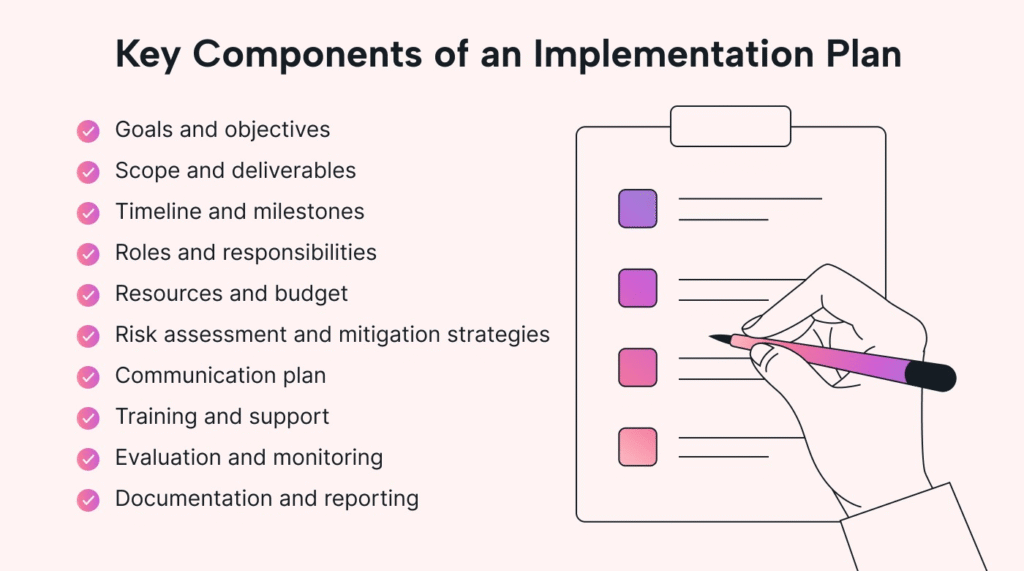

What Care Providers Should Do Next: A Practical Implementation Plan

The Employment Rights Bill introduces phased reforms, but preparation must begin now. Waiting until 2026 or 2027 will leave you reacting under pressure instead of leading with control.

Here is a structured plan to protect your organisation.

Phase 1: Immediate Review (Next 30 Days)

Focus on visibility and risk mapping.

- Audit all employment contracts for care assistants, support workers, and frontline staff

- Compare contracted hours against actual worked hours

- Review dismissal procedures and probation policies

- Update harassment policies to reference third-party situations

- Identify your highest-risk services (e.g., 24 hour home care, lone working)

This phase creates clarity. You cannot fix what you have not measured.

Phase 2: Systems and Training (Next 90 Days)

Strengthen operational foundations.

- Train managers on unfair vs wrongful dismissal

- Introduce structured investigation templates

- Update absence and sick pay policies

- Build rota tracking systems to monitor cancellations and pattern hours

- Create a harassment reporting flowchart for all staff

If you employ staff in assistant caregiver jobs, ensure managers understand how changes affect scheduling, probation handling, and disciplinary action.

Phase 3: Financial and Strategic Planning (Next 6–12 Months)

Prepare for cost and tribunal exposure.

- Model wage uplift scenarios under sector-wide pay negotiations

- Review council contracts for uplift mechanisms

- Create a compliance evidence folder (training logs, policies, risk assessments)

- Assign a named lead responsible for Employment Rights Act readiness

Care providers that treat these reforms as strategic governance will protect both margins and reputation.

The employment law changes 2025 will not reverse. Regulators, commissioners, and tribunals will expect preparation not surprise.

Conclusion

The Employment Rights Bill reshapes how care providers manage people, risk, and compliance. It strengthens worker protections, expands tribunal exposure, and raises the standard for prevention in areas such as harassment and dismissal.

For providers employing care assistants, support workers, and healthcare assistants, these employment law changes 2025 do not sit in isolation. They affect:

- Rota flexibility

- Contract structure

- Absence management

- Dismissal procedures

- Payroll controls

- Harassment prevention

- Financial planning

The organisations that treat this as an HR update will struggle.

The organisations that treat it as a board-level governance issue will adapt.

You must:

- Align contracts with real working patterns

- Strengthen documentation around performance and dismissal

- Build robust third-party harassment controls

- Model workforce cost exposure

- Preserve training and risk assessment evidence

The employee rights bill does not remove your ability to run a care business. It removes tolerance for weak systems.

Care providers who act early will protect margins, maintain commissioner confidence, and reduce tribunal risk. Those who delay will face pressure from every direction: financial, legal, and reputational.

The question is not whether these new rules in UK employment law will affect your service.

The question is whether your governance framework is strong enough to absorb them.

Ready to Strengthen Your Employment Law Compliance Before 2026?

The Employment Rights Bill is not just another policy update. It changes how you manage rotas, dismiss staff, prevent harassment, document decisions, and defend tribunal claims.

For care providers, weak systems will not survive these reforms. Strong governance will.

Care Sync Experts supports domiciliary care agencies, supported living providers, and care homes across the UK with:

- Full employment contract audits aligned with the Employment Rights Act 2025

- Zero-hours and predictable-hours compliance modelling

- Dismissal process reviews to reduce unfair and wrongful dismissal risk

- Care-specific harassment prevention frameworks and third-party risk controls

- Manager training on probation, absence management, and investigation standards

- Workforce cost modelling ahead of sector-wide pay negotiations

- Tribunal-readiness evidence pack design and documentation systems

- Policy updates covering sick pay, leave, rota flexibility, and reporting routes

Whether you operate 24 hour home care, supported living services, or large residential settings, we help you build employment systems that protect your margins, strengthen governance, and withstand legal scrutiny.

Get in touch with Care Sync Experts today and move into 2026 with confidence, control, and compliance-ready workforce systems.

FAQ

What are the 5 fair reasons for dismissal under the Employment Rights Act?

UK employment law recognises five potentially fair reasons for dismissal:

– Capability or qualifications (performance, skill, or health issues)

– Conduct (misconduct or gross misconduct)

Redundancy

– Statutory restriction (e.g., loss of required licence or visa status)

– Some other substantial reason (SOSR)

Even if you rely on one of these reasons, you must still follow a fair process. If you skip investigation, ignore evidence, or fail to hold a proper hearing, a tribunal may still find the dismissal unfair.

Do I need a new contract if my role changes?

It depends on the scale of the change.

Minor adjustments to duties, for example, adjusting certain care assistant duties within the scope of an existing job, usually do not require a brand-new contract.

However, you should issue written confirmation if:

– Hours change significantly

– Pay changes

– Reporting lines change

– Core responsibilities expand beyond the original care assistant job specification

– The role moves into a substantially different function

If you introduce predictable-hours adjustments or guaranteed-hour offers under the Employment Rights Bill reforms, you should document those changes formally.

Always consult the variation clause in the original contract before making changes.

Can an employer make changes to your job duties?

An employer can make reasonable changes if:

– The contract allows flexibility

– The changes remain within the scope of the role

– The changes are not discriminatory

– The employer consults properly where changes are substantial

For example, asking a support worker to assist with additional community activities may fall within scope. Asking them to perform a completely different professional function without agreement may not.

If changes significantly alter responsibilities, pay, or status, the employer should consult and agree the variation. Imposing major changes without agreement can lead to claims for constructive dismissal or breach of contract.

Can I be fired for refusing to do something not in my job description?

It depends on what you refused and how your contract is written.

If the instruction falls reasonably within your role, even if not explicitly listed in the assistant caregiver job description, refusal may amount to misconduct.

However, you may have legal protection if:

– The instruction is unsafe

– The instruction is unlawful

– The instruction breaches regulatory standards

– The instruction significantly exceeds your agreed role

For care providers, this often arises in safeguarding contexts. If a healthcare assistant refuses to perform a task because they believe it breaches care standards, you must investigate carefully before taking disciplinary action.

Always assess whether the instruction was reasonable and whether refusal connects to health, safety, or legal compliance.